A better way to Construction

Transform your construction business with Constructor's proven Construction Business Management software, the secret weapon behind Australia's top residential builders for over 20 years. Join us to grow, adapt, and lead in any market condition.

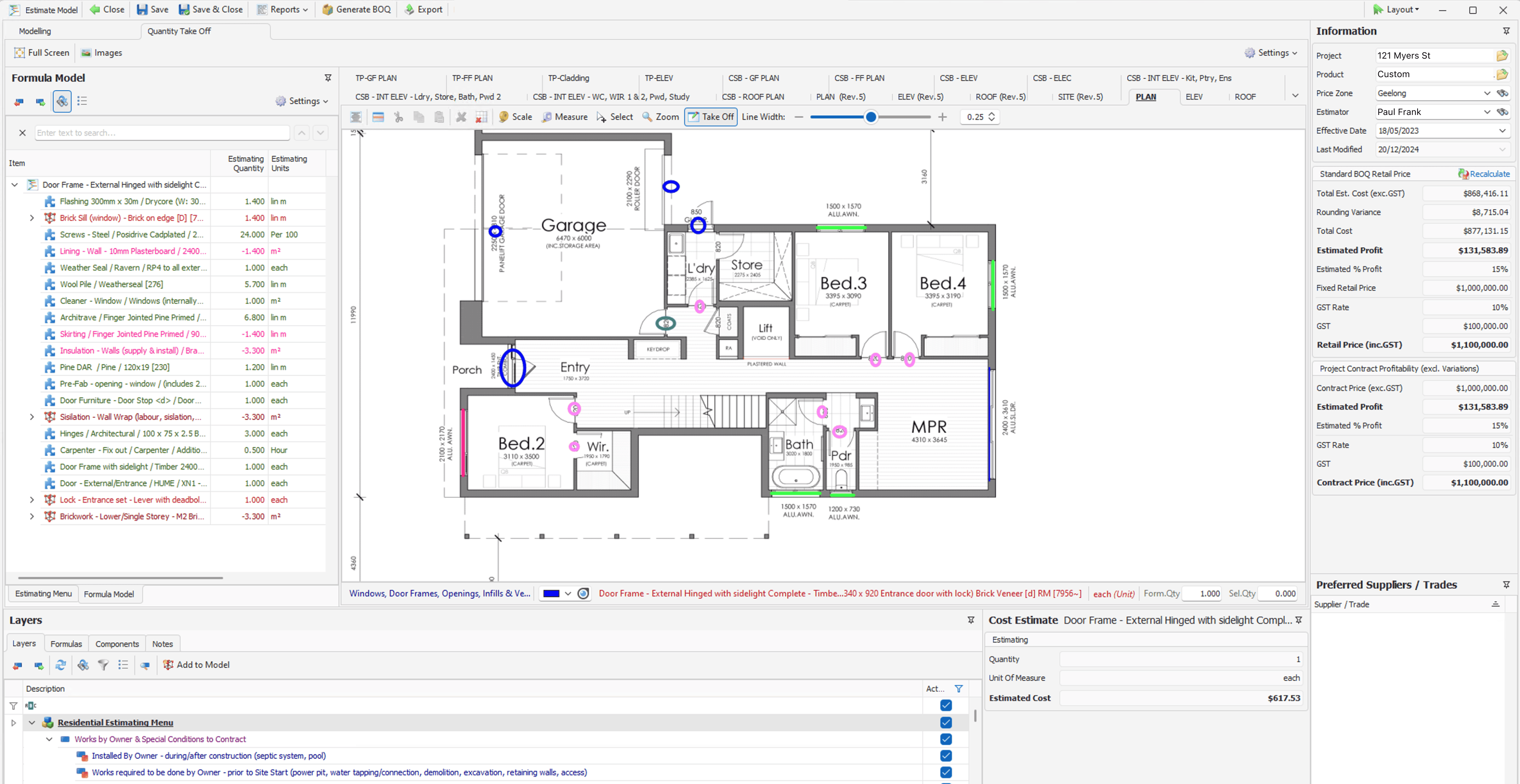

Estimating Software & Cost Control

Inflation? No Problem.

Take Control of your costs. Know your margins, cash position & profit on every job!

All in one Software Solution

Everything you need to get the job done

Have your entire business operations centralised in one system. No more double entering, no more lost data, a seamless system.

I've been using Constructor for 9 years now. And I've looked at a lot of systems in my time. But literally nothing could ever amount up to what Constructor has done for me.

The service has been great, I can always talk to someone at the Constructor team and get their assistance. The system is user friendly, does all of our accounting, payroll, estimating everything. I love the system, wouldn't change it for anything in the world.

Start Working on Your Business

Start working on your business again instead of in your business. Constructor gives you the tools to grow from just a few projects a year, to grow and build profitably on scale.

-

Fully Featured

- From Estimating, Cost Control, Budgeting, Reports, Accounting, Payroll, Scheduling. Constructor has it all and our team has your back.

-

Battle Tested

- Since 1995 Australia’s leading construction business and franchisers have chosen utilise the power of Constructor software.

-

Choosen Time & Again

- With over 2000 thousand users, it's no wonder why some of Australia's best builders & franchisers choose Constructor.

-

Unlock Your Business Potential

- The average Builder using Constructor does $20 million in annual revenue.